Intro

Following “B2BDeliverySample”, we would like to check the outline of the processing of the “B2BTaxSample” Apex Class

Outline of the process

The process of “B2BTaxSample” Apex Class consists of the following three major parts.

1. Obtain the cartDeliveryGroupId associated with the CartItem.

2. Retrieve the CartDeliveryGroup using the above ID as a clue

3. Store the set of SKU and CartItemID, SKU and total price in a map

4. Send the SKU, price, destination state, and destination country information to the external system, and get the Amount, TaxName, and Rate for each SKU, respectively.

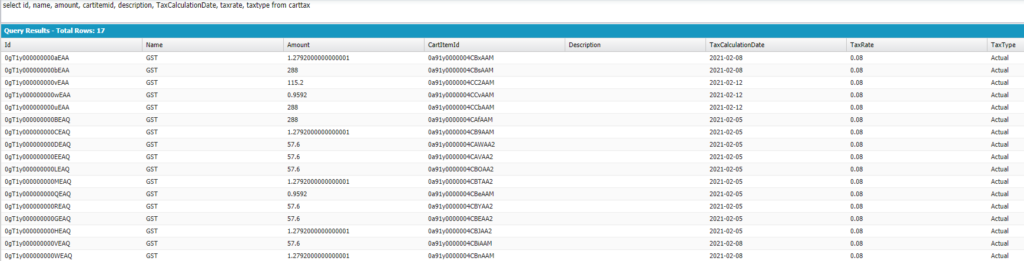

5. INSET the CartTax record associated with the CartItem based on the acquired information

Notes

When multiple delivery groups are implemented, it is necessary to change the process to loop through each delivery group.

Actual Code

// This must implement the sfdc_checkout.CartTaxCalculations interface

// in order to be processed by the checkout flow and used for your Taxes integration.

global with sharing class B2BTaxSample implements sfdc_checkout.CartTaxCalculations {

global sfdc_checkout.IntegrationStatus startCartProcessAsync(sfdc_checkout.IntegrationInfo jobInfo, Id cartId) {

sfdc_checkout.IntegrationStatus integStatus = new sfdc_checkout.IntegrationStatus();

try {

// In the Spring '20 release, there should be one delivery group per cart.

// In the future, when multiple delivery groups can be created,

// this sample should be updated to loop through all delivery groups.

// We need to get the ID of the delivery group in order to get the DeliverTo info.

Id cartDeliveryGroupId = [SELECT CartDeliveryGroupId FROM CartItem WHERE CartId = :cartId WITH SECURITY_ENFORCED][0].CartDeliveryGroupId;

CartDeliveryGroup deliveryGroup = [SELECT DeliverToState, DeliverToCountry FROM CartDeliveryGroup WHERE Id = :cartDeliveryGroupId WITH SECURITY_ENFORCED][0];

// Get all SKUs, the cart item IDs, and the total prices from the cart items.

Map<String, Id> cartItemIdsBySKU = new Map<String, Id>();

Map<String, Decimal> cartItemTotalPriceBySKU = new Map<String, Decimal>();

for (CartItem cartItem : [SELECT Sku, TotalPrice, Type FROM CartItem WHERE CartId = :cartId WITH SECURITY_ENFORCED]) {

String cartItemSKU = '';

if (cartItem.Type == 'Product') {

if (String.isBlank(cartItem.Sku)) {

String errorMessage = 'The SKUs for all products in your cart must be defined.';

return integrationStatusFailedWithCartValidationOutputError(

integStatus,

errorMessage,

jobInfo,

cartId

);

}

cartItemSKU = cartItem.Sku;

}

else if (cartItem.Type == 'Charge') {

// This is an example for a Cart Item of type shipping charge.

// For simplicity and testing purposes, we just assign some SKU to this charge so that the taxation external service returns some value.

cartItemSKU = 'ChargeSKU';

}

cartItemIdsBySKU.put(cartItemSKU, cartItem.Id);

cartItemTotalPriceBySKU.put(cartItemSKU, cartItem.TotalPrice);

}

// Get the tax rates and tax amounts from an external service

// Other parameters will be passed here, like ship_from, bill_to, more details about the ship_to, etc.

Map<String, TaxDataFromExternalService> rateAndAmountFromExternalServicePerSku = getTaxRatesAndAmountsFromExternalService(

cartItemTotalPriceBySKU, deliveryGroup.DeliverToState, deliveryGroup.DeliverToCountry

);

// If there are taxes from a previously cancelled checkout, delete them.

List<Id> cartItemIds = cartItemIdsBySKU.values();

delete [SELECT Id FROM CartTax WHERE CartItemId IN :cartItemIds WITH SECURITY_ENFORCED];

// For each cart item, insert a new tax line in the CartTax entity.

// The total tax is automatically rolled up to TotalLineTaxAmount in the corresponding CartItem line.

CartTax[] cartTaxestoInsert = new CartTax[]{};

for (String sku : cartItemIdsBySKU.keySet()) {

TaxDataFromExternalService rateAndAmountFromExternalService = rateAndAmountFromExternalServicePerSku.get(sku);

if (rateAndAmountFromExternalService == null){

return integrationStatusFailedWithCartValidationOutputError(

integStatus,

'The product with sku ' + sku + ' could not be found in the external system',

jobInfo,

cartId

);

}

// If the sku was found in the external system, add a new CartTax line for that sku

// The following fields from CartTax can be filled in:

// Amount (required): Calculated tax amount.

// CartItemId (required): ID of the cart item.

// Description (optional): Description of CartTax.

// Name (required): Name of the tax.

// TaxCalculationDate (required): Calculation date for this tax line.

// TaxRate (optional): The percentage value of the tax. Null if the tax is a flat amount.

// TaxType (required): The type of tax, e.g. Actual or Estimated.

CartTax tax = new CartTax(

Amount = rateAndAmountFromExternalService.getAmount(),

CartItemId = cartItemIdsBySKU.get(sku),

Name = rateAndAmountFromExternalService.getTaxName(),

TaxCalculationDate = Date.today(),

TaxRate = rateAndAmountFromExternalService.getRate(),

TaxType = 'Actual'

);

cartTaxestoInsert.add(tax);

}

insert(cartTaxestoInsert);

integStatus.status = sfdc_checkout.IntegrationStatus.Status.SUCCESS;

} catch(Exception e) {

// For testing purposes, this example treats exceptions as user errors, which means they are displayed to the buyer user.

// In production you probably want this to be an admin-type error. In that case, throw the exception here

// and make sure that a notification system is in place to let the admin know that the error occurred.

// See the readme section about error handling for details about how to create that notification.

return integrationStatusFailedWithCartValidationOutputError(

integStatus,

'An exception of type ' + e.getTypeName() + ' has occurred: ' + e.getMessage(),

jobInfo,

cartId

);

}

return integStatus;

}

private Map<String, TaxDataFromExternalService> getTaxRatesAndAmountsFromExternalService (

Map<String, Decimal> cartItemTotalAmountBySKU, String state, String country) {

Http http = new Http();

HttpRequest request = new HttpRequest();

Integer SuccessfulHttpRequest = 200;

String encodedState = (state == null) ? '' : EncodingUtil.urlEncode(state, 'UTF-8').replace('+', '%20');

String encodedCountry = (country == null) ? '' : EncodingUtil.urlEncode(country, 'UTF-8').replace('+', '%20');

Map<String, Decimal> encodedCartItemTotalAmountBySKU = new Map<String, Decimal>();

for(String sku: cartItemTotalAmountBySKU.keySet()) {

encodedCartItemTotalAmountBySKU.put(EncodingUtil.urlEncode(sku, 'UTF-8'), cartItemTotalAmountBySKU.get(sku));

}

// To access the service below, you may need to add endpoint = https://b2b-commerce-test.herokuapp.com in Setup | Security | Remote site settings.

String requestURL = 'https://b2b-commerce-test.herokuapp.com/get-tax-rates?state=' + encodedState

+ '&country=' + encodedCountry

+ '&amountsBySKU=' + JSON.serialize(encodedCartItemTotalAmountBySKU);

request.setEndpoint(requestURL);

request.setMethod('GET');

HttpResponse response = http.send(request);

// If the request is successful, parse the JSON response;

// The response includes the tax amount, rate, and name for each SKU. It looks something like this:

// {"SKU_1_september10-1568355297":{"taxAmount":2.8229012971048855,"taxRate":0.08,"taxName":"GST"},"SKU_0_september10-1568355296":{"taxAmount":5.0479003481482385,"taxRate":0.08,"taxName":"GST"}}

if (response.getStatusCode() == SuccessfulHttpRequest) {

Map<String, Object> resultsFromExternalServiceBySKU = (Map<String, Object>) JSON.deserializeUntyped(response.getBody());

Map<String, TaxDataFromExternalService> taxDataFromExternalServiceBySKU = new Map<String, TaxDataFromExternalService>();

for (String sku : resultsFromExternalServiceBySKU.keySet()) {

Map<String, Object> rateAndAmountFromExternalService = (Map<String, Object>) resultsFromExternalServiceBySKU.get(sku);

taxDataFromExternalServiceBySKU.put(sku, new TaxDataFromExternalService(

(Decimal)rateAndAmountFromExternalService.get('taxRate'),

(Decimal)rateAndAmountFromExternalService.get('taxAmount'),

(String)rateAndAmountFromExternalService.get('taxName')

));

}

return taxDataFromExternalServiceBySKU;

}

else {

throw new CalloutException ('There was a problem with the request. Error: ' + response.getStatusCode());

}

}

// Structure to store the tax data retrieved from external service

// This simplifies our ability to access it when storing it in Salesforce's CartTax entity

Class TaxDataFromExternalService {

private Decimal rate;

private Decimal amount;

private String taxName;

public TaxDataFromExternalService () {

rate = 0.0;

amount = 0.0;

taxName = '';

}

public TaxDataFromExternalService (Decimal someRate, Decimal someAmount, String someTaxName) {

rate = someRate;

amount = someAmount;

taxName = someTaxName;

}

public Decimal getRate() {

return rate;

}

public Decimal getAmount() {

return amount;

}

public String getTaxName() {

return taxName;

}

}

private sfdc_checkout.IntegrationStatus integrationStatusFailedWithCartValidationOutputError(

sfdc_checkout.IntegrationStatus integrationStatus, String errorMessage, sfdc_checkout.IntegrationInfo jobInfo, Id cartId) {

integrationStatus.status = sfdc_checkout.IntegrationStatus.Status.FAILED;

// For the error to be propagated to the user, we need to add a new CartValidationOutput record.

// The following fields must be populated:

// BackgroundOperationId: Foreign Key to the BackgroundOperation

// CartId: Foreign key to the WebCart that this validation line is for

// Level (required): One of the following - Info, Error, or Warning

// Message (optional): Message displayed to the user (maximum 255 characters)

// Name (required): The name of this CartValidationOutput record. For example CartId:BackgroundOperationId

// RelatedEntityId (required): Foreign key to WebCart, CartItem, CartDeliveryGroup

// Type (required): One of the following - SystemError, Inventory, Taxes, Pricing, Shipping, Entitlement, Other

CartValidationOutput cartValidationError = new CartValidationOutput(

BackgroundOperationId = jobInfo.jobId,

CartId = cartId,

Level = 'Error',

Message = errorMessage.left(255),

Name = (String)cartId + ':' + jobInfo.jobId,

RelatedEntityId = cartId,

Type = 'Taxes'

);

insert(cartValidationError);

return integrationStatus;

}

}